Why (and how) do personalities, self-concepts, and lifestyles influence consumer-related behavior choices? and how can marketers use this type of information?

Overview

With over 8 billion people on Earth, nobody is the same. Everyone has biases and preferences, with different backgrounds or lifestyles making almost every person unique. This is also true for consumers looking for products that align with their goals. A 43-year-old farmer with 3 children in Idaho, is not going to be looking for the same items as a 28-year-old single waitress in New York. This is an equation marketers need to solve, by sorting through the data in an attempt to bring the products they’re selling to the right people.

VALS and PRIZM

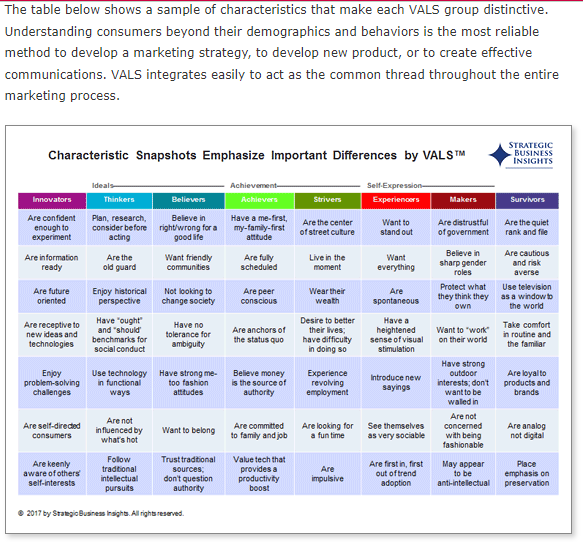

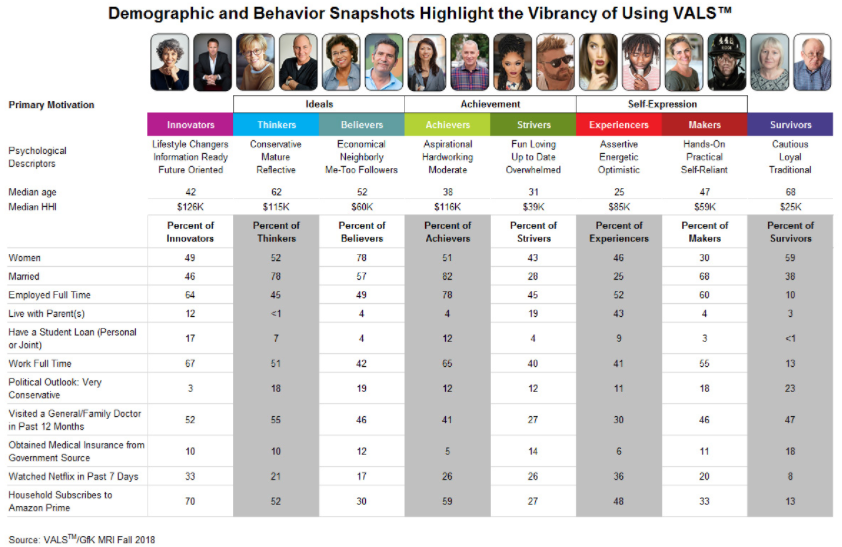

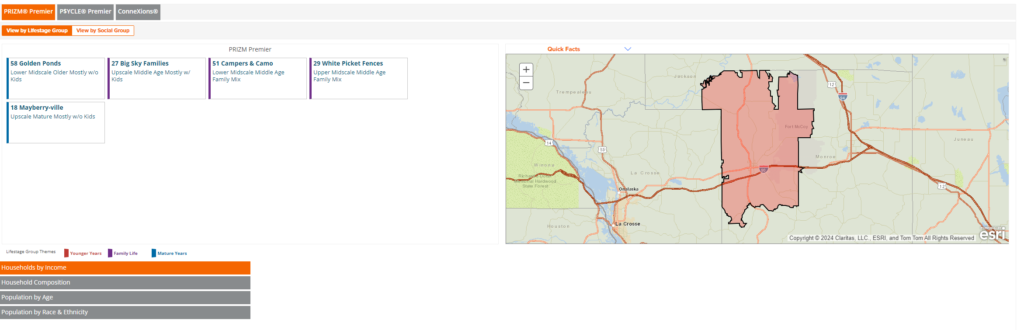

With the advancement of the internet, it’s now possible to group all of these different segments of consumers together, to organize a once messy process. One of the tools that accomplishes this is VALS. VALS splits up people into 8 groups based off of psychological descriptors and key demographics. These groups are made up of a combination of data plus statistics to help decide how a person will interact in a marketplace. Another tool called PRIZM accomplishes similar goals. It breaks segments down into “Lifestyle”/ “Social” groups. These are categorized by who they are, what they like, and where do they live. A more in-depth assessment compared to VALS. Marketers utilize these services as a way understand consumers, by seeing real data about how they feel.

My Results

To better understand the process of VALS and PRIZM, I went through the steps of each to get an idea of where I would fit in. Starting with VALS, my first course of action was to view the chart below to figure out where I best align. It took some time to carefully think about where I’m at in life, like the 8 groups. Eventually, I settled on the ‘strivers’ group. To test how much of an exact science VALS is, my next course of action was to view the second image below to compare. To my surprise it was very accurate. I can see why marketers spend so much time using VALS as a way to understand consumers.

Next, I spent some time with PRIZM to understand how it works and how accurate it is for my demographic. Just like with VALS, my next step was to go over the categories and find which one aligns with me. Starting with lifestyle group, my choices wound down to the ‘younger years’ section and eventually ‘generation web’. Reading the characteristics of this segment more often than not made sense for where I would be classified, with only slight discrepancies. Second, going through the social group tab it was very much the same. Finally, one of the options is to enter your zip code to see what the general population would be classified as. For my area, according to this website its mostly middle aged-older people with disposable income. This is mostly true and was surprised at how well it was presented.

Conclusion

With how many people there are who have millions and millions of characteristics, traits, and behaviors, marketers need to be creative when grouping them together. Tools such as PRIZM and VALS do some of the leg work by putting together information in easy-to-read summaries. It’s then up to marketers to use that information combined with their own intuition to figure out the best way to reach them. Not everyone is going to be a suitable target audience for a product, some will have strong feelings or be in a completely different state of life where it simply does not matter to them.